Contents:

According to the latest report published by Ericsson, the 5G technology will represent around 39 percent of mobile subscriptions in India at the end of 2027, estimated at about 500 million subscriptions. The Department of Telecommunications concluded the spectrum auction in July for airwaves including the ones for 5G connectivity. On Nov 7, 2022, the stock price of the company was INR167.60. On Nov 7, 2022, the stock price of the company closed at INR 1.30.

POCO F5 5G expected release date, specifications and other details – Economic Times

POCO F5 5G expected release date, specifications and other details.

Posted: Sat, 15 Oct 2022 07:00:00 GMT [source]

Check out the answers to the hottest questions regarding 5G penny stocks. However, it’s important to be cautious when trading penny stocks. The 5G penny stocks listed are in a great position to benefit from this expansion. Should you want to capitalize on this growing trend, there are still a few penny stocks worth checking out. The company is in the Information Technology space offering its best expertise and skill-sets with IT enabled solutions to the Telecommunication Sector. The company’s share price is expected to rise with the commercial launch of 5G services in India.

What are multi-bagger penny stocks?

The Department of Telecommunications in India approved on May 4, 2022, to trial the 5G readiness of the country for the next six months. If you want to invest in these 5g stocks, you need to open Demat account in any of the trading apps in India. The company has a presence in China, the US, Europe, and the Middle East nations. The company is planning to combine the power of optical, wireless, virtualization, and deployment methodology to build a 5G infrastructure for India and the world. The company provides telecom equipment to BSNL, MTNL, and defense. The company has contributed to 50% of the present national telecom network in the country.

On Nov 7, 2022, the stock price of the company closed at INR 80. On Nov 7, 2022, the stock price of the company closed at INR21.25. Vodafone Idea is a company formed from the merger between Vodafone and Idea, two of the biggest telecom operators in India. The company is working extensively for preparing for the upcoming 5G spectrum for all its customers. Her 15-year business and finance journalism stint has led her to report, write, edit and lead teams covering public investing, private investing and personal investing both in India and overseas. She has previously worked at CNBC-TV18, Thomson Reuters, The Economic Times and Entrepreneur.

It has a portfolio of ~26,000 towers which are located across all 22 telecom circles in India. Therefore, the company has emerged as India’s largest independent and neutral telecom tower company. GTL Infrastructure Ltd. has been categorized as a pioneer in shared passive telecom infrastructure in the country. The company deploys, owns, and manages telecom towers and communication structures that are shared by Wireless Telecom Operators.

Best 5G Stocks in India #1 – Bharti Airtel

Furthermore, they are prone to unexpected reductions in value owing to market conditions or new events within the organizations concerned. As in all other segments, Reliance Jio also wants to be the leader in the 5G space as well. The company has developed a 5G solution that is fully cloud-native and digitally managed.

- 5G will be a major talking point in India this year, and the next.

- Some penny stocks fade out and may be delisted over time, resulting in losses.

- Along with shares mentioned above, these are the stocks available below Rs 20 in India.

- The government had earlier suggested that the spectrum auctions for 5G would take place by the first quarter of 2022, but that is likely to be pushed further now.

- Sterlite Technologies has grown over the years to become the largest optical fiber and optical fiber cables manufacturer in the country with a market share of 45%.

- The company was incorporated in 1994 to set up and operate hydroelectric and Thermal Power projects and supply electricity from power plants in the country.

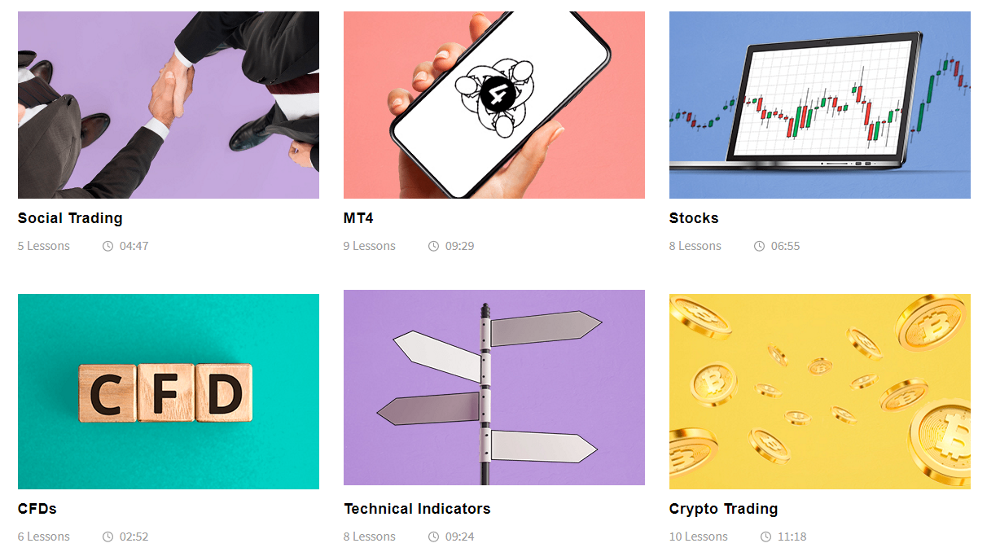

The company will enable 5G deployment through its dedicated network system unit for the deployment as well as commissioning of communications networks. Best stock discovery tool with +130 filters, built for fundamental analysis. Profitability, Growth, Valuation, Liquidity, and many more filters. Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters.

Penny Stocks: Final Thoughts

With majority holding of Bharti Group & Vodafone and global investors such as Canadian Pension funds this stock is bound to rally and can be next Hindustan Unilever in its own sector, where it is in monopoly. Coming to the financials of the company, it earned a revenue of Rs 551 Cr and posted a net loss of Rs 63 cr in FY22. However, Tejas network has not been able to generate adequate cash flow and the net profit margin has also been declining for the last 2 years. ITI Limited is a government-owned telecommunications equipment manufacturing company in India. It is under the ownership of the Department of Telecommunications. It has contributed to 50% of the present national telecom network in the country.

It is only when there is some news or some turnaround stories on penny stocks, that they move. The speculation leads to an increase in trading volumes and prices soar. But very few of them turn out to be true or genuinely strong on a fundamental basis. Over the past few years, communications companies have been rolling out 5G technology to improve the quality of their networks. Investors are taking note and are looking to get a hold of the best 5G penny stocks as an affordable entry point into this burgeoning tech. The stocks listed in the story are not ti nudge investors or readers to buy into these scrips.

The company’s 52 week has been Rs 4.19 while its 52-week high is Rs 13.8. The share is lastly recommended by HDFC Securities for a Target Price of Rs 19 . Being low on liquidity, penny stocks could be risky to invest in. Small company stocks traded for less than $5 per share are dubbed penny stocks. They aren’t usually listed on blue chip exchanges like NYSE, but instead are bought OTC — over the counter. Penny stocks are attractive to many because they’re cheap, while holding the siren-like allure of outsized gains if that plucky business does make it to the big leagues.

Liked this article, expecting more details like holding period… wud be helpful. Investing in such stocks always carries risk of losing a major part or whole part of your invested capital. Considering these things, it would be a good decision to book some or half of your profits at higher levels whenever your Penny stock has seen a good rally. If your stock reversed and came down again, you will be able to protect your profits. In case, the Penny stock continued to climb and turns out to be a Real MULTIBAGGER, then you will still have half quantity of shares to enjoy the journey. Now, when we know about the businesses of mentioned Penny stocks, lets quickly look at some queries which might come to your mind before investing in Penny Stocks.

India’s Top Sugar Stocks for 2023

Generally, a stock trading in penny price could be due to either very small size of the company, collapse of the business which resulted into heavy decline in shares, or financial problems. Whatever the reason could be, we must remember that such kind of scrips always carry good amount of risk and some carries huge risk also. Possibility of losing major part or even whole amount of invested money is always there. The introduction of 5G technology in India will boost the businesses of telecommunication service providers and telecommunication equipment companies. HBL Power Systems Ltd is a listed Indian company, in business since 1977, with a focus on engineered products and services. The company’s business strategy was to identify technology gaps in India that they could fill by ‘indigenous efforts.

There has been a lot of hype around Globalstar over the past year, as many people have realized just how effective its network could be for powering 5G devices. Shares made a segway down below $5 per share in January and have been holding there as the company finds its ground. Ribbon Communications also gives large enterprise clients a way to build their own internal networks that are efficient and secure.

Tejas Network is an optical, data networking, and broadband company. The company has built many IPs and emerged as a primary exporter to other developing countries in Africa and south-east Asia. Tata Group has acquired a 43.35 percent stake in the company. VI is an Indian telecommunication service provider formed after the merger of Vodafone India and Idea Cellular. It is the largest TSP in India and the 10th largest in the world. It will be able to connect everything and is expected to revolutionise mobile connectivity and user experience.

Infinix Zero 5G 2023, Zero 5G 2023 Turbo launched in India; Check for details – Economic Times

Infinix Zero 5G 2023, Zero 5G 2023 Turbo launched in India; Check for details.

Posted: Mon, 06 Feb 2023 08:00:00 GMT [source]

Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. Indus Towers, formerly Bharti Infratel, is a merged entity between Vodafone PLC and Bharti Airtel. The company will also deploy infrastructure for TSPs, which is critical for 5G installation.

Airtel 5G service will become available in all major Indian cities by 2023 and critical rural areas by March 2024. According to a report by the Global Mobile Suppliers Association, 5G is active in 61 countries. Australia, China, Canada, the USA, South Korea and European countries have activated 5G. The current market size for 5G is USD 53 billion, which is expected to reach USD 249.2 billion globally by 2026. Sterlite Technologies LimitedSterlite Technologies Limited is an Indian technology company that specializes in optical fiber and cables, hyper-scale network design, and deployment and network software. Telecommunications equipment companies play a vital role by creating the infrastructure required for digital transformation into 5G.

This shows the shares are undervalued when compared to the industry. Shares of the company are currently trading at a PE ratio of 7.8x, which is much below the industry average of 17.2x. It is primarily into printing and publishing newspapers and magazines.

5g penny stocks in india Ltd is an Indian multinational technology company. It is specialized in optical fiber and cables, hyper-scale network design, and deployment and network software. It has a global presence with offices in China, US, SEA, Europe, and MEA. The company plans to combine the power of optical, wireless, virtualization, and deployment methodology to build a robust 5G infrastructure for India and the world.

IOB’s provisions for bad loans have been slashed quarterly and there is hope for the stock to continue its multi-bagger performance similar to what investors saw in 2022. The repayment is a part of the company’s aim to become 100 per cent debt-free by the end of the FY24. Shares of Vikas Ecotech have yielded a massive return of 155 per cent in the last 2 years. Marketing and distribution of various financial products such as loans, deposits and Insurance are powered by Finzoomers Services Private Limited.

It offers voice and data services throughout India on second-generation , third-generation , and fourth-generation technologies. In India, penny stocks provide the most risk of any investment. This is because they are speculative and can provide bigger rewards as well as higher losses. As a result, if you are interested in penny stocks, it is best to begin modestly and gradually raise your investment as you go. Stocks that have rapidly dropped in value owing to financial concerns or corporate governance issues may end up in the penny stocks category. Penny stocks are sometimes very speculative, but traders may also use them to make profitable investments.

During the last three years, the company’s revenue has grown at a CAGR of 23.7% due to growth in exports. The net profit also grew at a CAGR of 42.8% during the same time. As of 31 March 2021, its debt-to-equity ratio stood at 0.1x, and the interest coverage ratio was 6.4 times. If bluechip stocks are taken to the cleaners, imagine the phase which penny stocks must have been going through.