Content

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Enhance brand equity and customer loyalty with the direct-to-consumer model. EY and P&G help organizations attain higher levels of manufacturing performance. We help CPR companies explore, identify and implement the right balance of bold strategic choices that will sustain their business today and transform it for relevance tomorrow.

- Our accounting, tax, and consulting service advisors deliver custom-fit guidance pointed squarely at our shared goal – your success.

- The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over.

- Retailer Rewarded by Early Revenue Recognition Adoption Analysis A retailer undergoing an enterprise resource planning system upgrade needed to know the impact of adopting the new revenue recognition standard.

- Manufacturers can find cost savings hidden in the production line or parts room.

- Supply Chain Reinvention helps clients effect a fundamental change in their performance to support sales growth, become more cost-competitive, minimize risk and improve operational resilience.

- Managing your caseload, office and staff is time-consuming enough – tap our expertise for help driving practice growth, improving efficiency and increasing overall profitability.

- We offer a comprehensive suite of services to a broad array of consumer product segments – apparel, accessories, diamond and jewelry, electronics, beauty, home, food and beverage, and toys.

5 Ways to Address Supply Chain Disruption The following tips may help companies respond to supply chain disruptions caused by the COVID-19 pandemic. A retailer undergoing an enterprise resource planning system upgrade needed to know the impact of adopting the new revenue recognition standard. Find out how the technology, banking and asset management sectors are adapting their strategies to handle today’s threats. Our NFT Playbook is a roadmap to addressing IP rights, business infrastructure and risk for media & entertainment companies and others. Manufacturers can find cost savings hidden in the production line or parts room.

Managing Director

If you form a map to find these savings, you can improve your tax strategy, operational metrics, bottom line and even top line. Why are retailers planning to take on debt even in the face of a potential recession? How do Retail CFOs plan to deal with the fallout from the supply chain strain that has left them at times with not enough inventory, and at other times too much? What vulnerabilities can be shored up by simply going back to the basics with a supply chain strategy? In this episode of our 60-second Retail podcast, Ted Vaughan, Assurance Managing Partner and Retail and Consumer Products Leader of the Southwest region at BDO USA, unveils some of the key findings from the 2023 Retail CFO Outlook Survey. An overview of the state of U.S. retail in the second half of 2022, including bankruptcies and store closings.

- BDO provides audit, tax and advisory services to traditional retail, consumer product and e-commerce companies, ranging from emerging businesses to multinational Fortune 500 corporations.

- With the rise of e-commerce, need for financing, and highly-competitive markets, we understand the challenges that retail and consumer products industries face.

- Companies in this sector need to be strategic at every turn in order to maximize efficiencies and increase profits.

- We offer tailored accounting and tax solutions that consider both the retailer and supplier perspective.

- Our Consumer Products Group is comprised of seasoned professionals with decades of experience who understand industry and specific market forces that drive business decisions.

- The current retail landscape presents challenges to both the retailer and their supplier, however with challenges to both the retailer and their supplier, however with challenges come opportunities.

We understand that the combination of what you sell, how you sell, and where you sell is uniquely you and creates one-of-a-kind needs. Whether you’re a brick and mortar business, an established online shop, or looking to shift into e-commerce, turn to our professionals to guide you at every turn to strengthen your standing in changing marketplaces. Disruptive technologies, new business models and agile market entrants are revolutionizing the way people shop, what they buy and how they live.

Related Industries

Retailers focus on providing excellent customer service and offering a sufficient assortment of quality products that are competitively priced. FORVIS understands the challenges you face and knows how to help you overcome construction bookkeeping them. FORVIS accounting pros can help with supply chain logistics, digital retail growth strategies, daily operations, and more. Retail-focused tax, accounting, and advisory services and innovative insights.

Tune in to hear why Ross Forman, Managing Director in the Workplace Operations & Strategy Group at BDO USA, is keeping a close eye on these troubling trends. Listen in to the very first episode of 60-second Retail – International Edition, where we are joined by Laura McNaughton, Consumer Brands M&A Partner for BDO UK, to do a side-by-side comparison of the U.K. In this episode we examine why BNPL has become so popular with consumers, and discuss the growing risks retailers are taking on in today’s economy in order to spur big ticket item sales.

Meet Our Professionals

An intense focus on sustainability has consumers and companies at every stage of the value chain rethinking their habits, priorities and ways of doing business. Nexia International Limited does not deliver services in its own name or otherwise. Nexia International Limited and each of its member firms are separate legal entities and not part of a worldwide partnership.

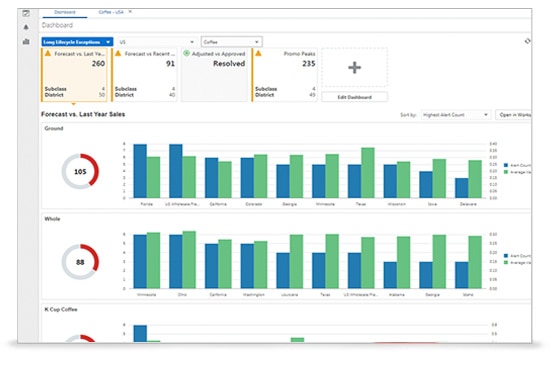

Next-Gen Key Account Management Next-Gen Key Account Management Tectonic shifts in the retail landscape and rapidly evolving shopper needs require CPGs to reinvent themselves. Next-Gen Key Account Management enables you to work closely with retailers to jointly identify and execute optimal value-creation strategies. Bain Perfect Store Bain Perfect Store Transform your sales with data-driven decision-making powered by proprietary software, analytics, systems, tools, and training. Our 18th annual Architectural and Engineering Studies include detailed analyses of key financial benchmarks to help A&E firms assess their strengths and weaknesses. Our specialists in accounting standards help you prepare for the implementation of significant changes in accounting guidance such as revenue recognition and accounting for leases. Marcum offers a powerful combination of people, products, technologies, and results-oriented strategies.

Let PKF O’Connor Davies be the go-to source for your accounting, auditing, tax and cyber needs.

The 2022 Marcum Year-End Tax Guide provides an overview of many of the issues affecting tax strategy and planning for individuals and businesses in 2022 and 2023. Internal accounting departments may be focused on complying with the tax changes in South Dakota vs Wayfair , but there are also financial reporting considerations that come into play with sales and use taxes. We can harness the power of people, process, data https://www.world-today-news.com/accountants-tips-for-effective-cash-flow-management-in-the-construction-industry/ and technology to transform your company’s tax operating model into a strategic function of the business. Supply Chain Reinvention helps clients effect a fundamental change in their performance to support sales growth, become more cost-competitive, minimize risk and improve operational resilience. California Court of Appeals rules on when sales and use tax can make marketplace retailers liable for uncollected sales tax.